The way we pay is changing, fast. Customer expectations have shifted, and businesses can no longer afford to rely solely on traditional payment methods. If you want to reach more customers, drive conversions, and stay ahead of your competition, alternative payment methods (APMs) are essential.

APMs offer businesses and consumers greater flexibility, convenience, and often affordability. However, no single APM is dominant, and preferences vary significantly across locations and demographics.

As Andres Treviño, Zone Payments Management AVP at L’Oréal, shared in his interview for our My Path in Payments series, “At the end of the day, it’s about meeting the customer where they are at, and providing choice at the moment of payment which will translate into more sales and a better customer experience.”

But what exactly are APMs, and why do they matter for your growth strategy? In this article, we break it down – what APMs are, how they work, and how the right mix can maximize revenue opportunities for your business.

What are alternative payment methods?

Alternative payment methods – APMs for short – are any type of payment method that isn’t cash or a traditional credit card from a major international card scheme, such as Visa, Mastercard, or American Express.

Domestic cards, cash-based vouchers, digital wallets – such as Apple Pay and Google Pay – or bank transfers, including iDEAL in the Netherlands and Przelewy24 in Poland, are all considered alternative payment methods.

Despite the term alternative, APMs are often more mainstream than niche. In many countries, they’re the de facto way to pay, particularly online. In 2024, 213.7 million shoppers used PayPal monthly in the United States, 111 million in Germany, and 55.2 million in the UK.

In the meantime, in the Netherlands, consumers make 73% of all online purchases with iDEAL – that’s a staggering 1.3 billion transactions.

For businesses looking to attract customers globally, selling online without accepting their preferred payment method is akin to leaving money on the table.

See how Papa John’s UK and Delivery Hero are using alternative payment methods through Checkout.com to improve their customer experience and boost acceptance rates.

Types of alternative payment methods

- Prepaid cards: Prepaid cards are loaded with funds by the user and used to make purchases up to that amount. They can be topped up with additional funds. Unlike debit cards, they aren’t linked to a bank account, and unlike credit cards, they don’t involve borrowing.

- Cash-based payments (e-cash): Customers generate a barcode or unique acquirer reference number (ARN) at checkout, which they then use to pay in cash at a participating retail location. Once confirmed, the merchant processes the order. An example is Multibanco in Portugal.

- Account-to-account (A2A) transfers: Consumers pay for goods and services online using direct transfers from their bank accounts. Examples include Bizum in Spain and EPS in Austria.

- Direct debit: Direct debit is commonly used for recurring payments, allowing merchants to pull funds directly from a customer’s bank account with prior consent and notice. Examples include SEPA and ACH.

- Domestic card schemes: Domestic card schemes operate similarly to Visa and Mastercard, but are only accepted in specific markets. They’re often preferred locally as they’re tailored to unique consumer needs and offer merchants lower processing costs. Examples include Bancontact, Cartes Bancaires, and Mada.

- Digital wallets: Digital wallets store payment cards electronically, allowing users to pay online, in-app, or in-store without manually entering card details. They often support peer-to-peer and cross-border payments too. Digital wallets can be loaded via bank transfer, card, cash, or linked directly to a payment card or bank account. For enhanced security, they typically use tokenization, replacing sensitive card details with a unique, transaction-specific token. Examples include Apple Pay, Google Pay, PayPal, Alipay, and Venmo.

- Buy now, pay later (BNPL): BNPL lets customers pay in full at a later date or split purchases into installments – typically using a bank account, debit, or credit card. Alma, Tabby, and Tamara are popular providers.

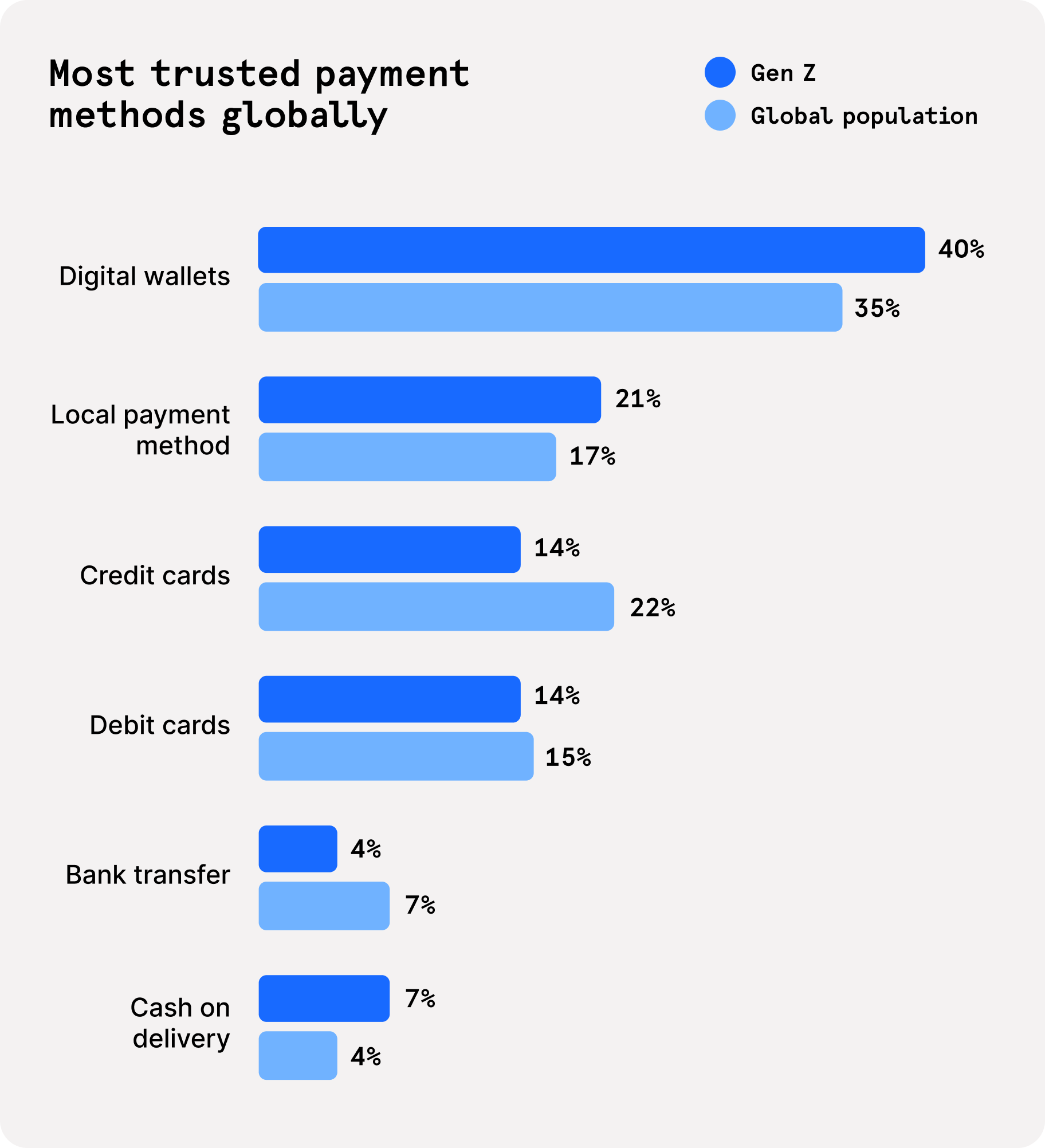

We recently surveyed 8,000 consumers around the world on trust in the digital economy and found that digital wallets are the most trusted global payment method. Discover more in our report.

Alternative payment method preferences by region

There is no single, global way to pay. Every country has unique banking rails, payment methods, regulations, requirements, and licensing. Payment habits also develop over time and are often formed by various cultural, political, economic, and technological factors.

North America

In 2024, digital wallets were the leading payment method for ecommerce in North America, accounting for a 39% market share of transaction volume (TPV) – surpassing credit cards at 32%. Digital wallet usage in U.S. ecommerce is expected to reach a 52% market share by 2030. PayPal remains the leading digital wallet, while Apple Pay dominates mobile.

Meanwhile, in Canada, the projection is similar, with digital wallet usage expected to reach a 47% market share by 2030.

Localized payment methods are growing in popularity, particularly amongst the younger generation. In Q2 2025, US-based Venmo processed 81.98 billion U.S. dollars, an 11.9% year-on-year increase. It’s the most popular among females, consumers between the ages of 30 to 44, and higher-income households.

Latin America

Digital wallets are gaining ground in Latin America; they accounted for 22% of the region’s total ecommerce TPV in 2024. Although not quite caught up with credit cards (30%) and A2A (24%) just yet, by 2030, the market share is projected to hit 29%.

Given the region’s large unbanked population, cash-on-delivery, e-cash solutions like OXXO Pay in Mexico, and real-time payment systems like Pix in Brazil are becoming more widespread. Pix is the largest A2A payment system in Latin America.

Leading studies predicted that Pix would overtake credit cards as the most popular ecommerce payment method in Brazil this year. While that’s still under play, a 74% adoption rate among Brazilians in just two years since its 2020 launch shows it’s a payment method to be taken seriously.

What catapulted Pix’s success – and Brazil’s shift to a digital-first payments mindset – is clear: deeper financial inclusion, mobile penetration, ecommerce growth, and regulatory changes. Brazil now leads Latin America in digital banking usage and ecommerce.

Europe

Like in the US, digital wallets (33%) in Europe have the highest market share of all payment methods, compared to debit and prepaid cards (20%) and credit cards (19%). And by 2030, digital wallets should hit 46% market share.

In the UK, digital wallet usage is expected to surpass Europe’s average by reaching 58% market share by 2030. By 2028, the total ecommerce transaction volume handled by digital wallets in the UK is forecast to be 86% higher than in 2023. The digital payment brand with the highest brand awareness in the UK is PayPal.

However, the UK market is still dominated by cards, with debit cards being the most preferred type.

Domestic debit cards, sitting alongside global brands, remain popular elsewhere in Europe, like Bancontact in Belgium and Cartes Bancaires in France. Consumers in France also favor digital wallets like PayPal and Google Pay.

BNPL is growing across the region, particularly among younger, tech-savvy consumers. And A2A methods like SEPA, iDEAL, Vipps, Bizum, and Swish are all increasing in popularity across their respective markets.

Want to know more about how to master payments in Europe? Our guide covers the latest payment trends in the region, from alternative payment methods to regulations.

Africa

In Africa, mobile wallets are attractive due to a lower bank branch infrastructure, large rural population, and a rising penetration rate of credit cards, debit cards, and bank accounts. Customers can load their mobile wallets in various ways, including cash, carrier billing, or bank transfer.

Payment preferences aren’t distributed evenly across the continent. Cash on delivery (40%) is still the preferred method for online retail in much of the region, especially Nigeria (66%), followed by card. However, digital wallets have experienced some growth, and are the preferred method for online transactions in Kenya (19%) and Nigeria (16%). East and West Africa have some of the highest mobile money TPV in Africa.

In South Africa, credit cards are the most common payment method for online shoppers (43%), followed by bank transfer (22%), and e-wallets (20%). Mobile payment methods are used by 22.8% of internet users each month, which is only 1.2% below the global average.

In Kenya, the TPV of digital wallets in ecommerce is set to almost quadruple by 2028 (US$4.76 billion) compared to 2023 (US$1.23 billion).

In some African countries, nearly the entire population has a bank account. In others, the bank account penetration rate is as low as 13%.

Instant money transfers are popular in Africa, but mostly via mobile money. Mobile money supported US$38 billion out of US$41 billion real-time fund transfers made across the continent in 2023. Nigeria even ranks higher than the UK and the U.S. in the number of instant payment systems.

Middle East

In the Middle East, cash has reigned supreme until recently. Significant internet and smartphone penetration has resulted in a rising preference for mobile wallets in one of the fastest-growing regions for mobile technology adoption.

This shift was driven by deeper penetration from international brands, urbanization, and the development of government-backed payment networks. Examples include KNet in Kuwait, OmanNet in Oman, QPay in Qatar, Mada in Saudi Arabia, and Jaywan in the United Arab Emirates.

In Saudi Arabia’s Vision 2030, the government has set out to achieve the goal of increased economic diversification (among other goals). Included within that is a push to be 80% cashless by 2030. Similarly, the UAE government established the Dubai Cashless Strategy in 2024 to ensure 90% of all transactions in the government and private sectors are cashless by 2026.

Asia Pacific

China has a robust domestic card scheme, UnionPay, which has a 99% market share of payment cards. This kind of in-market local card scheme dominance isn’t seen in other countries, where usually Visa or Mastercard is the largest card provider.

Despite that, wallet dominance is nearly complete in China. Alipay (704.37 million monthly active users) and WeChat Pay are overwhelming leaders.

Digital wallets accounted for 74% of ecommerce transaction value in APAC in 2024, the highest globally. But in China, this was significantly higher at 84%, while countries like Australia (39%) and New Zealand (29%) were much lower due to the popularity of credit and debit card payments in both countries. Australia and New Zealand have the highest share of BNPL payments in ecommerce transactions in the region.

Over 50% of consumers use mobile payment methods in Thailand, India, Vietnam, Indonesia, and Malaysia. In Hong Kong, local wallets like Octopus Wallet retain niche power in transit and small daily purchases.

There is a large variety of popular alternative payment methods used by consumers across the region. Some examples include PayNow in Singapore, Dana in Indonesia, True Money in Thailand, and POLi in Australia.

Japan’s market remains card-heavy, but is seeing significant growth in domestic wallets and convenience store payments.

Read our guide on how to master payments in APAC to discover more on choosing the right alternative payment methods in the region.

What are the benefits of accepting alternative payment methods?

Not accepting customers’ preferred payment methods is a conversion killer. Our research, conducted in partnership with Oxford Economics, showed that 56% of consumers are permanently put off shopping on a site if they can’t use their payment method of choice.

Indeed, cart abandonment, when a potential customer adds items to their basket but never completes the purchase, is a big risk for merchants who offer a limited range of payment options. Whether it’s down to trust, eagerly awaiting payday, or convenience, customers need choice.

Alternative payment methods must be a key part of your payment strategy. In fact, we consider APM integration a vital online payment system feature. Customers like what is familiar. If they usually pay a certain way, why would they do something new to shop with you? When convenience is key to closing sales, the last thing you want is to add extra payment friction.

And it’s not enough to be reactive. You're too late if you only start offering APMs when they reach critical mass. By this point, your potential customers will already be spending money with your competitors who catered to their needs sooner. Instead, you must be proactive and foster a deep understanding of the direction local trends are heading in. This way, you’ll go beyond customer expectations and deliver first-class payment experiences before your competitors beat you to it.

Discover more about how alternative payment methods can reduce chargebacks, covering the security and time-saving benefits of APMs and how they can reduce fraudulent payment disputes.

How to choose the best alternative payment method for your business

The challenge for merchants is knowing where to start getting this information. Nuances in the way people pay are subtle. And that’s where it helps to partner with experts who have a deep understanding of the local markets you operate in. They’ll work with you to understand and develop strategies to capture opportunities ahead of your competitors.

You also need to make sure that your payments technology stack is suited for your business – allowing you to add new payment methods at speed, without additional complexity. Make sure that you’re working with a provider that gives you the international coverage you need, as well as capabilities to evolve as your business develops.

Here’s how to choose the best alternative payment methods for your business:

- Understand your customers: Payment preferences vary considerably between different demographics, not just regions. Research the most popular payment methods among your target market and ensure you offer them at checkout.

- Understand your business: At the same time, consider which APMs are right for your business needs and requirements. For example, how does the cost per transaction affect your bottom line? How easy is it to set up and manage? Does it meet the regulations you need to abide by? You don’t need to offer every single APM to maximize conversions, and some can hurt your business.

Explore alternative payment methods with Checkout.com

By offering customers their favorite ways to pay, you’ll increase conversions, reduce cart abandonment, and open your business to entirely new markets. Think ahead, adapt quickly, and choose partners with the expertise and technology to scale payment options without complexity. With the right APM strategy, you’re allowing yourself to stay ahead.

At Checkout.com, you can gain valuable insights and access our comprehensive range of alternative payment methods, specifically designed to meet the needs of your business.

There’s clearly a lot to consider, and it’s hard to know when to offer the right payment method to the right person. But Flow helps take the stress away by doing exactly that, wherever your customers are. You can add and test new payment methods via configuration, not code.

Checkout.com’s Unified Payments API also gives you immediate access to all the local payment methods and digital wallets you need to create smarter regional strategies and happier customers.

Get in touch to see how Checkout.com can help build and support your APM strategy.

%20thumbnail.png)

.jpeg)

%20v1.jpg)

.png)

.png)