Any time a customer attempts to make a payment, the transaction needs to be authorized, meaning their bank confirms that the customer has enough funds in their account or that the payment isn’t suspected of being fraudulent.

Authorization rates reflect the efficiency and reliability of a merchant’s payment process, so the higher yours is, the better.

Below, we explain how to improve authorization rates, why authorization rates are important for merchants to track, and how they relate to payment declines.

What is the authorization rate?

The authorization rate is a key metric in payments that measures the percentage of attempted transactions that are successfully authorized by the issuing bank or card network. While there are similarities with conversion rate, the two are not synonymous, as conversions measure the success of getting your customers to complete a desired action.

To calculate your authorization rate, you simply divide the number of payment authorizations by the number of attempted transactions. For example, if a merchant processes 1,000 payment attempts and 950 of them are approved, the authorization rate is 95%. Understanding this data is essential for all businesses that want to optimize their customer experience and their sales.

What are the benefits of improving authorization rates?

Maintaining a high authorization rate is vital to the success of all businesses, but especially online businesses. Ideally, your customers will complete their payment on the first try. When they’re not physically present, it’s easy for them to just abandon the payment altogether after even one decline.

Increased revenue

The simple fact is that higher authorization rates equal more completed payments, which equates to more revenue coming into your business. For a big business, that processes a high volume of transactions every day, this is even more true: even small improvements in your authorization rates can translate into massively increased revenue, while a high rate of declines can indicate critical losses.

Customer satisfaction

Keeping customers happy is also vital to your success, and ensuring their payments are successful is the cornerstone of that happiness. Declined transactions create resentment, and consistently declined transactions could result in not only lost payments but also lost customers.

By contrast, doing everything you can to maximize first-attempt success is the best way to maintain strong relationships with your customers.

What are common authorization rate issues?

It’s a good idea to understand what issues could be causing low authorization rates for your business. How do you identify these issues?

Firstly, analyze data from your Payment Service Provider (PSP) to discover which factors are affecting your authorization rate. The factors could range from problems with the issuing bank to the transaction amount. Once you’ve found the factors, it’s time to build an optimization strategy around them to improve your authorization rate.

Soft declines

Soft declines occur due to temporary issues or lack of funds in the account. They can usually be retried automatically or resolved quickly with customer action.

Examples of soft declines include:

- Insufficient funds

- Processor unavailable

- Do not honor

Soft declines can become successful transactions quickly if appropriate next steps are taken.

Hard declines

Hard declines occur due to fixed issues, such as a deactivated or stolen card, and should not be retried – merchants can’t resolve these issues.

Other examples of hard declines include:

- Incorrect bank routing numbers

- Holds placed by the cardholder’s bank

- Wrong account numbers

It’s considered bad practice to retry hard declines and can hurt your authorization rate if done. In most cases, a hard decline can’t be turned into a successful transaction and a new payment method will be required from the customer.

How to improve authorization rates

If your authorization rates are low, you’re missing out on revenue that could be the difference between the success and failure of your business. Customers can reattempt payment, but a decline could be enough to dissuade them from making the transaction entirely.

Authorization rates are a part of the control, and there are many steps you can take to improve them. Here’s how:

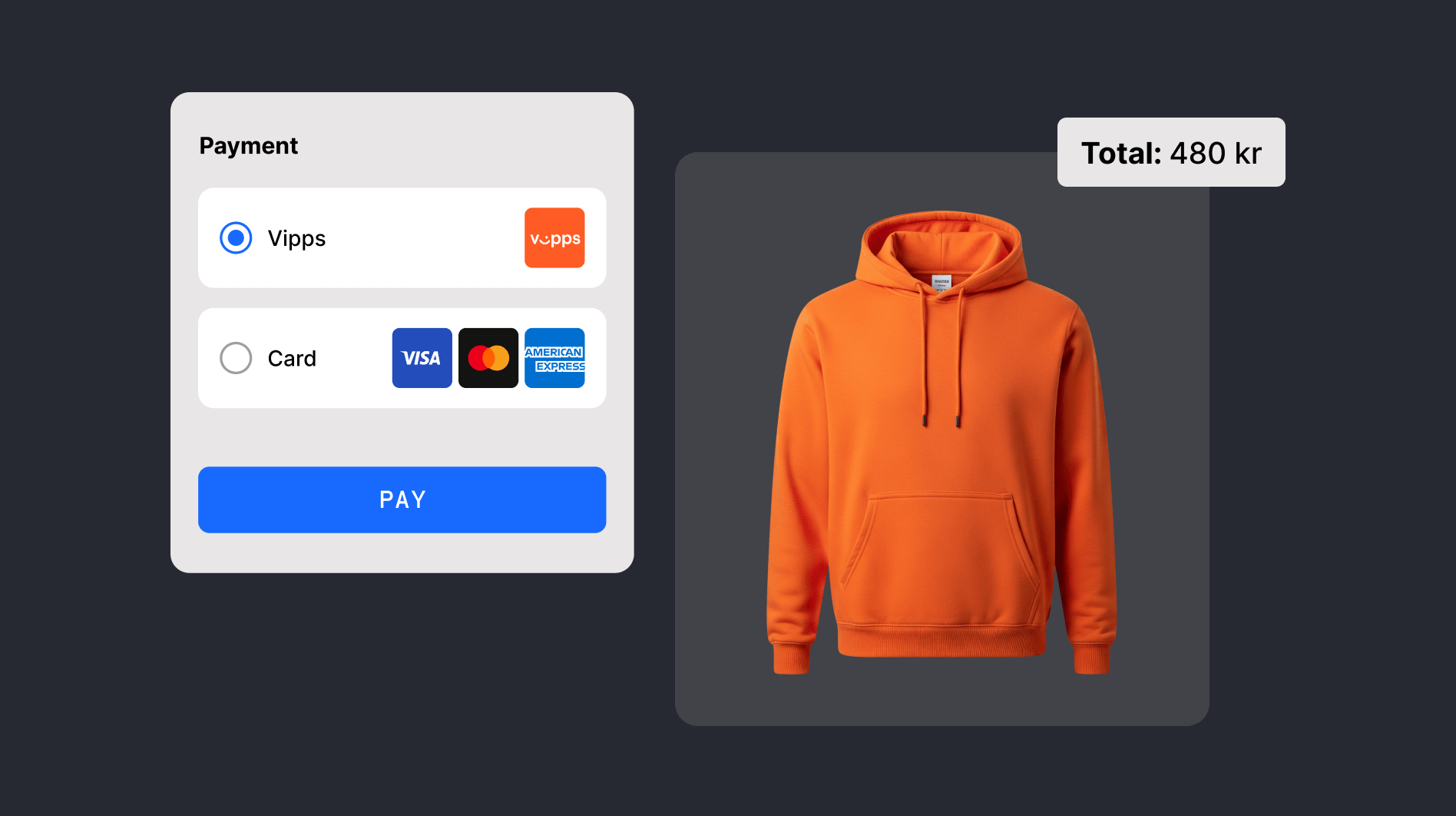

Offer digital wallets as payment methods

Digital wallet payments like Apple Pay and Google Pay generally have higher acceptance rates than other methods. That’s because they rely on factors like biometric data to verify the cardholder, resulting in easier and more accurate authorization. So it’s wise to offer them to your customers as payment methods.

Optimize your payment flow

If your business model relies on taking payments at a future date, you can increase the chances of authorization by choosing the optimal time to charge your customers and how much to charge them.

For example, if you run a rental company, you could collect 10% of the payment upfront and 100% once the rental is complete. Or you could collect the full payment at the time of booking. The better option for your business depends on what products you’re renting and who your customers are.

Strive to find the right balance between customer experience and costs to optimize your payment flow and improve your authorization rates.

Collect all important billing information

Banks are understandably cautious, so anything you can do to signal trustworthiness is good. The more information you can provide in your charge requests, the more likely the customer’s bank is to verify the payment as legitimate. For example, to maximize authorization rates, you should collect and submit the customer’s ZIP code and CVC, as these are vital for credibility.

Use network tokens

Accepting network tokens is another great way to improve authorization rates. These tokens are unique payment credentials that take the place of a credit card’s 16-digit primary account number (PAN). The advantage of a token is that it enables successful transactions without exposing the cardholder’s sensitive information to theft by fraudsters.

Use payment authentication

Making use of 3D Secure 2 (3DS2), a payments security protocol, can help significantly improve your authorization rates. That’s because it makes use of advanced verification processes like biometrics (face and fingerprint scanning) and multi-factor authentication (One-Time Passwords and other data) and uses risk-based authentication (RBA) to categorize and route transactions based on risk level with minimal disruption to the customer. That results in reduced cart abandonment and higher conversions.

Maintain low levels of fraudulent activity

A reputation for fraudulent activity, such as a high rate of chargebacks as a result of customer disputes, is bound to produce lower authorization rates. The best way to defend against this is to prevent your business from falling victim to fraud in the first place.

Invest in a reliable fraud detection and prevention system to identify and block suspicious activity. You can customize the rules your system uses to stop fraud and how it routes transactions depending on their trustworthiness. For example, low-risk transactions are processed immediately, while higher-risk ones prompt 3DS verification. These systems also leverage machine learning to take on a lot of the heavy lifting for you and to make more accurate decisions.

Understand response codes

Response codes, or credit card authorization codes, are two-digit number pairings that tell the merchant whether or not a card transaction was successful and if it was declined, why that might be.

Codes can indicate whether the payment was approved, a soft decline, a hard decline, or a referral. Soft declines, such as when there is a temporary issue or not enough funds in the account, can be retried. Hard declines, which can occur when a card has been deactivated or reported stolen, should not be retried. If you receive a code indicating a soft decline, you can quickly retry the payment and, hopefully, authorize the transaction.

Automatic retries can be implemented so that when a transaction fails due to a soft decline, you can try to push it through again without any manual action required.

You could build an automation flow to trigger activities off the back of certain decline codes. These could be:

1. If a payment for a high-value item is declined due to unavailable funds, it could trigger an email to be sent to the customer with a Buy Now Pay Later payment link

2. If a 3D Secure request times out, it could trigger an email to be sent to the customer with information about how to authenticate a payment through their banking app

Download our guide on optimizing your authorization rates to learn how to diagnose declines and how to utilize key data to drive performance, as well as the value of choosing the right payment partner.

Optimize your authorization rates with Checkout.com

Checkout.com provides merchants with powerful tools for boosting their authorization rates.

We give you access to granular and actionable data that offers deep insights into everything from customer behavior to how money is flowing in and out of your business. Better data equals better performance because it allows you to respond quickly to issues and optimize every stage of your payments process.

Checkout.com also provides more than 150 response codes, so you can understand exactly why banks are declining payments and take steps to rectify any issues.

Our local acquiring licenses improve authorization rates too, because local issuers are more likely to authorize transactions from a local acquirer than cross-border settlements.

Get in touch with our team of experts and start improving your authorization rates with Checkout.com today.

.png)