When it comes to strategies for integrating payment methods, two paths emerge: direct integration, and integrations via payment services providers (PSPs). Both offer distinct advantages and drawbacks, posing a crucial question – which is the right choice for your business?

Does direct integration work?

Direct integration enables you to meticulously build your payment infrastructure, brick by brick, affording you unparalleled control over every facet, such that the payment experience aligns seamlessly with your brand identity and caters to the distinct preferences of your customers. This method presents several advantages.

Benefits of direct integration

- Unmatched control: Design a checkout process that seamlessly aligns with your brand identity and caters precisely to your customer's needs, ensuring a tailored and unique experience.

- Potential cost savings: By eliminating fees associated with PSP services, there is the potential for a reduction in transaction costs over the long term. However, it is crucial to exercise caution and weigh the gained expertise and additional features offered by a PSP against the costs and efforts involved in building and maintaining your payment infrastructure independently.

- Greater data ownership: Direct integration provides access to granular transaction data, enabling a more profound understanding of customer behavior. This level of insight may not be uniformly offered by all PSPs, granting you a strategic advantage in comprehending and leveraging transaction-related information.

Drawbacks of direct integration

In weighing the decision to pursue direct integration, it is imperative to conduct a comprehensive assessment, considering the intricacies involved in terms of technical capabilities, associated costs, and the strategic trade-offs between control and convenience.

- For example, building and maintaining your payment infrastructure demands significant in-house technical resources to manage security, compliance, and ongoing maintenance. The associated costs, both initial and ongoing, can be substantial.

- Assuming the responsibility for PCI compliance and fraud prevention exposes you to potential security vulnerabilities. Rigorous measures must be implemented to safeguard sensitive information and uphold the highest standards of security.

- Integrating multiple regional payment methods poses a complex and resource-intensive task, potentially overshadowing any cost savings achieved through reduced transaction fees. This limitation could impact your ability to cater to a diverse global audience.

Integration via a payment services provider

PSP-driven integrations, on the other hand, outsource the heavy lifting, allowing you to focus on your core business. We're experienced in payment gateway integration services, focusing on problem-solving for payment gateway integration challenges. Let's look at the pros and cons of integration via a third party.

Benefits of integration via PSP

- PSPs can typically provide faster implementation and a streamlined integration process, often requiring minimal technical expertise on your end.

- They can also reduce risk by shouldering PCI compliance and fraud prevention burdens, offering robust security measures.

- Finally, PSPs can unlock global reach at scale – you can easily access a diverse range of payment methods and regional expertise, simplifying international expansion.

Drawbacks of integration via PSP

When considering a PSP-driven integration, it's important to keep the following trade-offs in mind:

- Fees: Using a PSP's services will incur fees, which may impact your profit margins. However, you should compare these fees to the total cost of a direct integration, including development, maintenance, and potential security breaches.

- Customization: PSP platforms may restrict flexibility in the checkout experience, which could limit your ability to customize the experience. If customization is important to you, choose a PSP that offers customization options like branding.

- Data dependency: Access to transaction data may be limited compared to a direct integration. It's important to choose a PSP that provides data access or collaborates with you for data analysis, depending on your needs.

Read more: How an integration health check can improve payment performance

Why Checkout.com

In the end, choosing between the integration options depends on your unique needs and resources. Typically, direct integrations are ideal for tech-savvy businesses with significant resources and a desire for control, particularly if minimizing transaction fees is crucial. PSP-led integrations work for businesses seeking faster implementation, reduced risk, and global reach. Ultimately, the key is to carefully weigh your priorities and partner with a solution that best navigates you through the payment labyrinth, propelling your business toward success.

With access to 150+ processing currencies and 20+ settlement currencies, combined with our proprietary payment platform and dedicated partnership, Checkout.com is the perfect partner to support your core and emerging business lines. Our commitment to continuous innovation means you'll always have access to the latest features and technologies, ensuring that your payment processing stays ahead of the curve.

Focus on what matters: Offload security, compliance, and global reach concerns onto our shoulders. Our dedicated customer success team guides you every step of the way, ensuring a smooth integration and ongoing support.

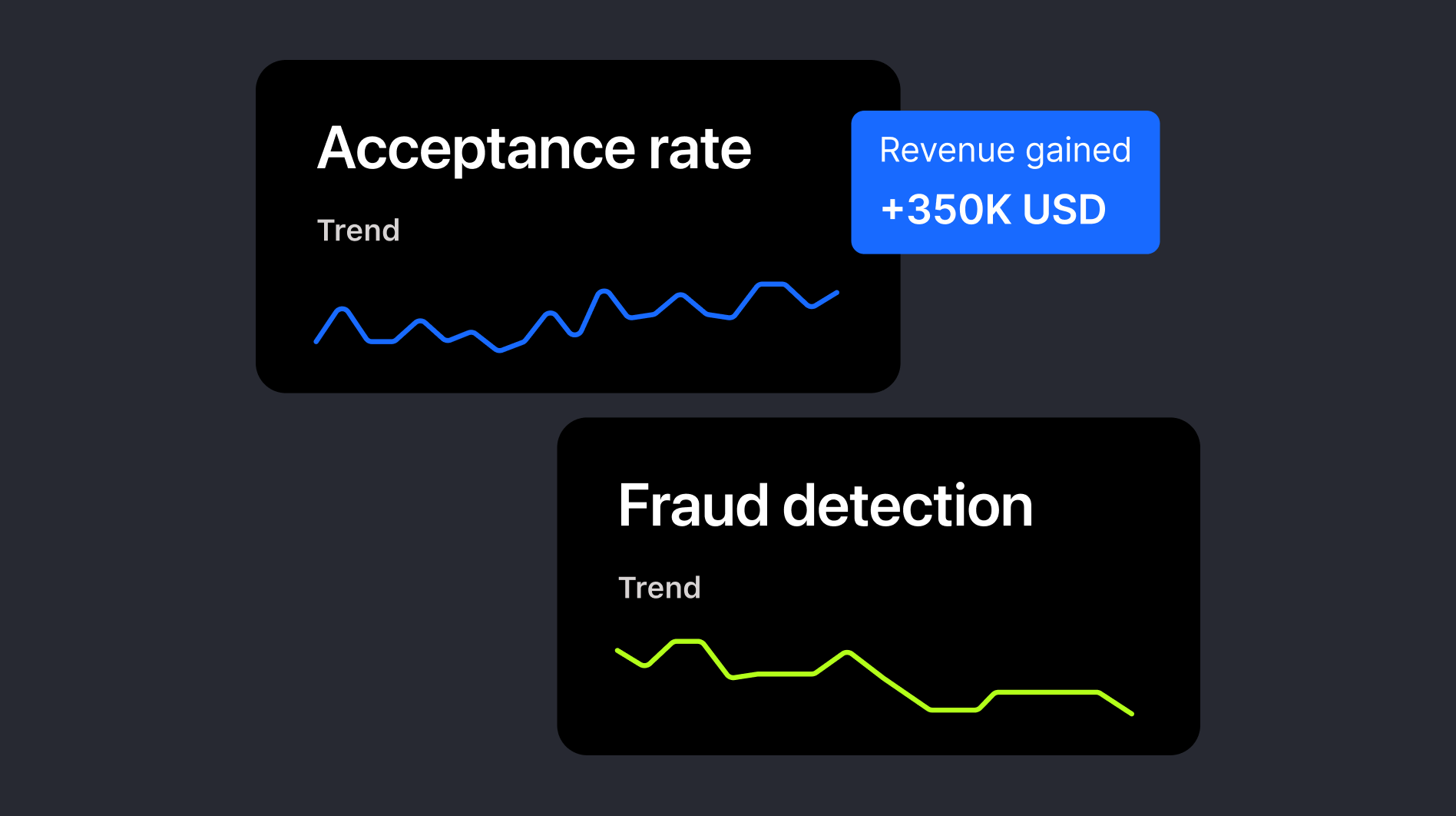

Harness the power of AI: Gain valuable insights from actionable data captured and analyzed using our cutting-edge AI tools. Identify trends, optimize conversion rates, and personalize customer experiences for better business decisions.

Craft your perfect checkout: Enjoy unparalleled customization options to tailor the payment experience to your brand and customer preferences. No more one-size-fits-all solutions!

Simplify integration: Our unified API streamlines access to a diverse range of payment methods across APAC, Europe, MENA, and the US, including popular global and localized payment methods. Expand your reach and cater to local preferences seamlessly.

.jpeg)

%20v1.jpg)

.png)

.png)