When you take payments from customers in other countries, or send money to overseas suppliers, it’s tempting to think that there’s only two parties involved: you and them.

In reality, cross-border payments are far more complex. Behind the scenes, multiple banks and financial institutions may be involved, many of which don’t have a direct relationship with one another. To move money securely between them, a third party is often required to ‘broker’ the deal.

That’s where intermediary banks come in.

In this guide, we’ll explain what an intermediary bank is, how intermediary banks work, when you may need one, how fees are handled, and how they differ from correspondent banks – so you can better understand and optimize your cross-border payment flows.

What is an intermediary bank?

An intermediary bank is a financial institution that acts as a middleman in an international money transfer.

Its role is to help route funds between two banks that don’t have a direct relationship, often because they operate in different countries, currencies, or banking networks. It bridges the gap between two different bank accounts held by two different banks, to ensure the transaction moves forward smoothly.

Intermediary banks are most commonly used in international wire transfers, especially those processed via the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network.

Intermediary bank examples

Because intermediary banks must maintain relationships with banks across many regions and currencies, they are typically large, global financial institutions.

Some examples of intermediary banks include:

- HSBC

- Citibank

- Deutsche Bank

- Barclays

- Bank of America

- Wells Fargo Bank

- JPMorgan Chase

- The Bank of New York Mellon

- BNP Paribas

- Standard Chartered

How do intermediary banks work?

Here’s a simple example to illustrate how an intermediary bank works in practice.

Jacques, who lives in France, wants to send money to his cousin Mathilde in the United States. Jacques uses a small local French bank, while Mathilde banks with Capital One in the US.

Jacques submits the transfer request and chooses to cover all fees himself (known as the OUR fee standard).

Because Jacques’s bank doesn’t have a direct relationship with Capital One, it routes the payment through an intermediary bank – such as HSBC – that holds accounts with both institutions. That intermediary bank may also work alongside a correspondent bank to handle the currency exchange before the funds reach Mathilde’s account.

From Jacques’s perspective, the transfer looks simple. Behind the scenes, however, multiple institutions coordinate to move the money across borders.

Do intermediary banks charge fees?

Yes. Intermediary banks act, in a way, like agents. And, like all agents, they charge fees for the services they provide, which may include:

- Payment routing and processing

- Currency conversion

- Access to international banking networks

Because these fees are so varied, it makes it hard to pin down exactly how much intermediary banks charge. Also, they’re often opaque, meaning senders and recipients may not see them itemized in advance.

Intermediary bank fees vary based on several factors, including:

- The banks involved

- The countries and currencies involved

- The payment method (for example, wire transfer)

- The transaction amount and urgency

Who pays intermediary bank fees?

While intermediary bank fees themselves aren’t transparent, SWIFT defines three common fee arrangements:

- OUR: The sender pays all fees, and the recipient receives the full amount

- BEN: The recipient pays all fees; deductions are taken from the transfer

- SHA: Fees are shared between the sender and recipient

Understanding these options is key to avoiding unexpected deductions in cross-border payouts. For more information about the hidden costs of cross-border payouts, explore our comprehensive guide to the topic.

When is an intermediary bank required?

An intermediary bank is typically required when an international bank transfer is taking place between accounts from two banks in different countries that don’t have a direct relationship or may lack the infrastructure to process international payments independently.

Smaller or regional banks often rely on intermediary banks to access global payment networks, especially for international wires.

How to find intermediary bank information

As a merchant, you don’t usually need to select or manage intermediary banks yourself. These relationships are typically handled by banks or payment service providers (PSPs) to provide the senders and recipients of international money transfers with the quickest, most cost-effective solution.

For more information about the intermediary banks involved in your cross-border transactions, though, you can reach out to your payment service provider – like Checkout.com – or access the details from your online payments dashboard.

They can provide details such as the intermediary bank’s name, location, and SWIFT/BIC code.

What's the difference between intermediary banks and correspondent banks?

Understanding the exact differences between intermediary and correspondent banks can be tricky – especially because they fulfill so many of the same functions and the terms are often used interchangeably.

Both are involved in facilitating international payments, but there are general differences. The main difference is the amount of currencies they handle transactions in.

Intermediary banks handle transactions for two parties, but in one currency. They focus on enabling the transfer itself.

Correspondent banks handle transactions in more than one currency. Because of this, they commonly play a larger role in currency exchange, using the SWIFT network to process multi-currency international payments. They also support a wider scope of services like Nostro and Vostro settlements and check clearing.

In practice, a correspondent bank can also act as an intermediary bank, depending on the transaction and region.

Simplify international payments with Checkout.com

If your business operates internationally and accepts payments from overseas accounts, understanding intermediary banks is vital. But managing complexity doesn’t have to be.

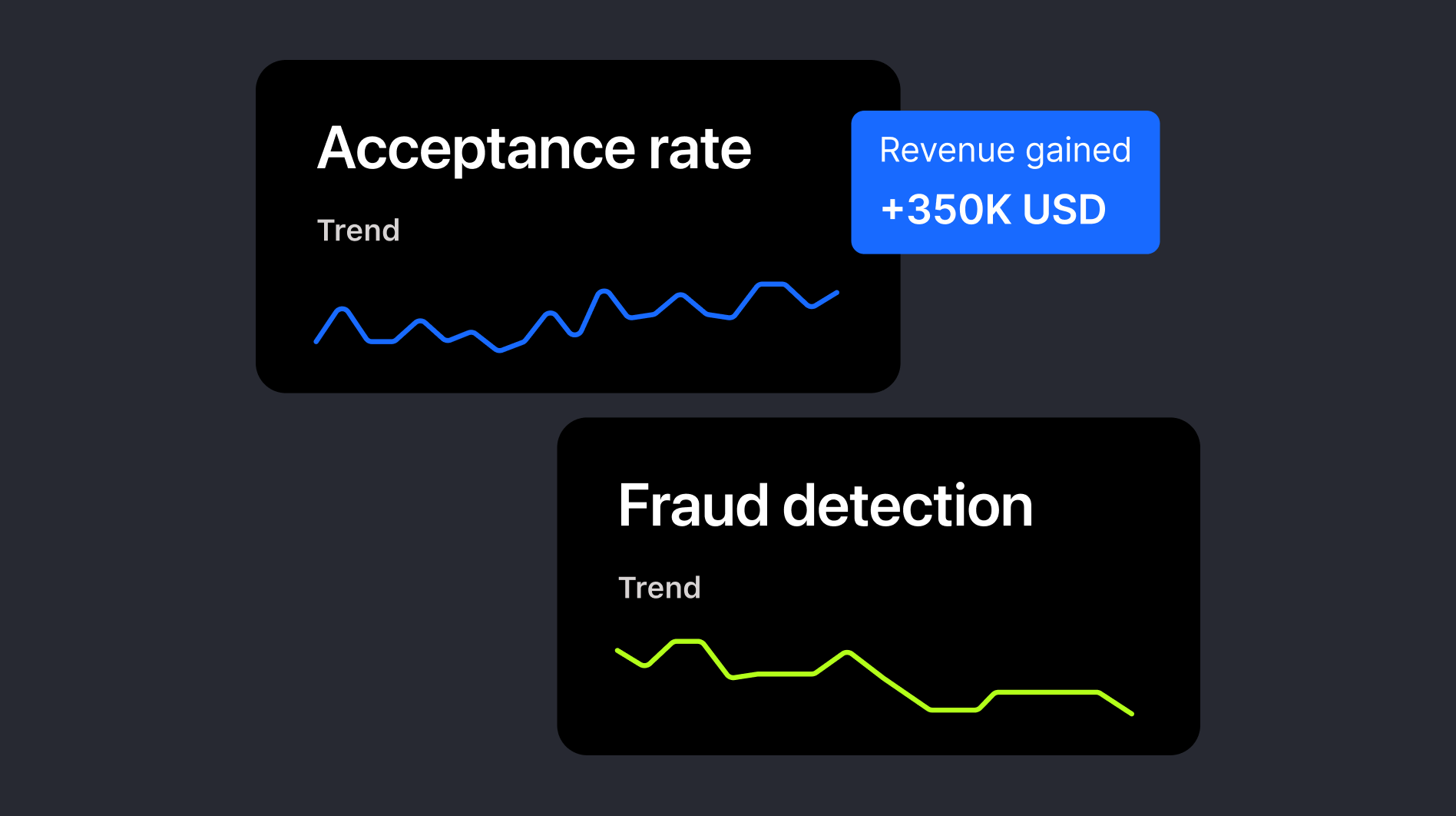

With Checkout.com, you’ll benefit from our wide international coverage – accept payments in over 150 currencies and settle in almost 20. You can accept almost 50 payment methods, from the world’s biggest credit and debit cards to digital wallets and popular local payment methods like Kakao Pay or Mada. Our experts will also work with you to boost your approval ratio, making cross-border payment failures a thing of the past.

Our infrastructure is designed to minimize uncertainty, improve performance, and help your business scale globally with confidence.

Get in touch with our team today to learn how Checkout.com can simplify your cross-border payment strategy.

.jpeg)

%20v1.jpg)

.png)

.png)