As a merchant, making and receiving prepayments is a vital part of doing business – and comes with a huge array of benefits.

Receiving prepayments can give you better cash flow and more accurate forecasting, and offers cost-saving and convenience for your customers. While making prepayments helps you more accurately allocate resources – and enjoy your own time and cost-savings.

So, how can you use prepayments to make your business’s life easier? First, you’ll need to know exactly what prepayments are, how they work, and why they matter.

Below, we’re answering all these questions – and more. We’ll discuss how to record both incoming and outgoing prepayments in your business’s balance sheet, explain payment penalties, and unpack the difference between accrual basis and cash basis accounting. And, most importantly, explore why picking the right payment processor is crucial for helping you juggle your prepayments – and leverage faster, more accurate payments performance.

What is a prepayment?

A prepayment is the act of making a payment for a product or service before it’s officially due – or before those goods, or that service, has been provided.

Essentially, a prepayment is one made ahead of the agreed-upon schedule.

Anyone – whether individuals, businesses, or any other type of organization – can make a prepayment. And they apply to various situations: such as loans, rent, subscriptions, or any other type of bill or expense. While a prepayment is similar to a deposit, deposits generally only cover a portion of the total owed amount. Prepayments cover the full cost.

How do prepayments work?

In a typical sales process, orders are made by the buyer, then fulfilled by the seller.

Once the goods or services have been delivered, the seller sends an invoice, which – depending on the net payment terms involved – is paid within a set, pre-agreed timeframe.

Some payments, however – be it due to the nature of the service, or the relationship between the buyer and seller – need to be made upfront, before the goods are delivered. These ‘prepayments’ happen for a variety of reasons, and in a wide range of contexts. When your business receives a prepayment, for instance, it might be because:

- The buyer wants preferred treatment for an order

- You won’t extend credit to that buyer

- You’re offering a discount or deal for prepayment on an ongoing service (such as for a subscription, where committing to a set period of time saves the customer money)

- The buyer wants to pay early to record the purchase as an expense within that (earlier) accounting period

From an accounting perspective, you’ll typically record a prepayment you’ve received as a current liability, and any prepayment you’ve made as a current asset. (We’ll explain more about how to record prepayments in your business’s balance sheet below.)

What is an example of a prepayment?

We’ve discussed the principle of prepayments – but how do they look in practice?

Some examples of prepayment include:

- Purchasing goods or services as prepaid assets: you might purchase office supplies in bulk, for instance, and pay for them upfront.

- Repaying the interest on a business loan: you might take out a loan, and make an upfront payment to cover the first few months’ worth of interest. This prepayment reduces the interest expenses that would end up accumulating over the long term.

- Prepaying your annual insurance premium: you might pay this in advance to cover your property and liability insurance. (This prepaid premium is recognized, officially, as an asset until the end of the coverage period.)

- Making tax prepayments: you might estimate your tax liability for the year ahead, and pre-pay a portion of the total to the government. (You’ll record this as a liability until the actual figure is calculated.)

Sometimes, of course, the merchant isn’t the one making the prepayment – but receiving it. Here, a prepayment might look like:

- Customers purchasing subscription goods: you might sell subscription boxes (like meal kits or misshapen vegetables). The customer, to access a discount, pays upfront for the entire year. You record this as a liability until the last box is delivered.

- Customers making advance payments: when a customer makes a custom order, you may require them to pay upfront. This payment is recorded as a liability until your business has delivered the product or service.

Benefits of prepayments

Prepayments offer a huge array of benefits for all involved – including you, as the merchant (the seller or provider of the goods and services), and your customer (the buyer).

Let’s break those benefits down, first, for merchants. Prepayments provide:

- Better cash flow: by promising an instant influx of funds, prepayments help you manage your day-to-day operations, cover your expenses, and forecast more accurately for your business’s financial future. Immediate payment also enables you to invest in growing your business now, rather than being hamstrung by lengthy payment terms.

- Lower risk of non-payment: by receiving the money you’re owed upfront, you reduce the likelihood of your customers defaulting on payments – or canceling orders after the product or service has already been provided.

- Higher customer lifetime value (CLV): by accepting and incentivizing your customers to pay upfront (offering them discounts or special offers on longer-term contracts or subscriptions, for example), you can engender lengthier, more sustainable commitments to your brand.

- More efficient resource allocation: with prepayments letting you know exactly where your business stands, you can plan your inventory, staffing, and production needs based on orders that are already confirmed.

- Less administrative hassle: with prepayments, you’ll spend less time chasing payments and grappling with your accounts receivable – freeing you up to focus on your business’s core operations and ambitions.

How about the benefits for customers? Offering them the opportunity to prepay gives them:

- Cost-savings: by prepaying, customers can often access special discounts or pricing, saving them money on expensive month-to-month subscriptions.

- Convenience: prepayments help customers manage their budgets by paying in advance: rather than in monthly, ongoing installments that can be difficult to manage. Plus, because prepayments can be merchant-initiated transactions (MITs), the customer can pre-agree to the payment, without then having to take further action – which is extremely convenient for them.

- Availability: in high-demand situations, prepayments can give customers guaranteed access to products, services, or bookings – often ahead of time, and ahead of other customers.

- Incentives: beyond allowing customers to save money, prepayments can also offer them added value in other ways – such as through extended warranties, extra services, or loyalty rewards.

How do you record a prepayment in a balance sheet?

How you record a prepayment in your business’s books will depend on whether you’re making the prepayment, or receiving it.

How to record an outgoing prepayment

When you make a prepayment, it’s treated as an asset on your balance sheet until the goods or services you’ve bought are received in full.

Let’s say you, as a business, purchase a subscription for HR software with a Software-as-a-Service (SaaS) provider. It works out cheaper to pay for two years upfront, rather than on a monthly, recurring billing basis. So you make this prepayment (so called because you haven’t received the entirety of that two-year service yet) and record this in your business’s prepaid expenses account as an asset.

The total value of the two-year deal is $2,400 – so, $200 per month. Every month, then, you’d charge $200 of the total HR software subscription to the HR expenses account, to reflect each subsequent month’s usage of that total initial outlay. By the end of the two-year period, the prepaid asset is eliminated, and the $2,400 is reflected as an expense to the HR department.

How to record an incoming prepayment

When you receive a prepayment from your customer, it’s considered a liability – at least until you’ve delivered the purchased products or services to your customer in full.

Let’s say, for example, that you receive a prepayment of $2,000 for a product you’ll be delivering over the course of the next three months. This $2,000 enters your balance sheet as unearned revenue (so, a liability). Each of the following months, as you provide the service or deliver the goods, the liability decreases, and the revenue increases.

So, you’d debit $667 per each subsequent month from your unearned revenue total, while crediting it to your sales revenue total. After three months, that liability will be wiped, and your sales revenue will be $2,000 to the good.

What is the difference between accrual and cash basis accounting in prepayments?

Accrual and cash basis accounting are two different methods of recognizing and recording financial transactions – including prepayments.

So what’s the difference? Let’s explore.

Accrual basis accounting in prepayments

Accrual basis accounting records transactions when they’re incurred – regardless of when the funds actually change hands.

This accounting method recognizes when the goods or services are received, or delivered – even if the payment took place earlier or later. The underlying logic or goal of accrual basis accounting is to match revenues with expenses in the periods they occur – thus providing a more accurate overall picture of a business’s financial health.

In accrual basis accounting, prepayments you make are initially recorded as assets, then – when the services or products are used, or consumed – gradually recognized as expenses.

Prepayments you receive are initially recorded as liabilities on your balance sheet as unearned revenue – before becoming recognized as revenue as your customer consumes the goods or services you’ve provided.

Accrual basis accounting is more complex than its cash counterpart, but provides a more granular, accurate representation of your business’s financial performance and position. As such, it’s required for larger companies, and is in line with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Cash basis accounting in prepayments

Cash basis accounting records transactions only when money actually changes hands.

This accounting method doesn’t take into account when the product or service is delivered, received, or used; it’s based solely on the timing of cash inflows and outflows.

In cash basis accounting, prepayments you make are immediately recorded as expenses on your income statement – regardless of when the services or products are consumed.

Prepayments you receive are recorded, straight away, as revenue – irrespective of when you dispatch or deliver the goods or services to your customer.

Cash basis accounting is more simple than the accrual variety, but – because of the potential mismatch between cash flow and economic activity – generally doesn’t provide as accurate a depiction of your business’s financial health.

What is a prepayment penalty?

While prepayments offer a rich set of benefits, there’s one potential drawback to making them – and that’s a prepayment penalty.

A prepayment penalty is a charge a creditor or lender imposes when a borrower pays off a loan or debt before its agreed-upon maturity date. Prepayment penalties are most commonly associated with installment-based loans: such as car loans, personal loans, and mortgages.

Let’s take mortgages as an example.

When the bank pays out the home loan, it’s banking on a certain return threshold, which it calculates based on the size of the mortgage, the interest rate, and the duration of the loan. If you pay up your home loan earlier than expected, the bank misses out on a potentially significant chunk of the income it expected – so it passes down a penalty to compensate.

A prepayment penalty might be:

- The percentage of the loan’s outstanding balance

- The percentage of interest savings (where the penalty is based on the interest that would’ve been earned had the loan been paid off in line with the original schedule)

- A fixed amount (if applicable, this figure should be set out in the initial agreement)

Improve your payments performance with Checkout.com

Accepting and receiving prepayments has a wealth of benefits: from forecasting your business’s cash flow to future-proofing your brand and bottom line through more engaged, loyal customers.

That all requires efficient accounting and a focused, fastidious approach to balancing your business’s books. And all that requires intuitive, unencumbered access to all your business’s latest payment data. Without it, you’ll struggle to know who’s paid, who’s prepaid, who hasn’t paid. With it, you’ll have all these figures at your fingertips – ready to integrate seamlessly with your accounting and reconciliation efforts.

How can you get this data? Partnering with a reliable payment service provider like Checkout.com is an excellent place to start.

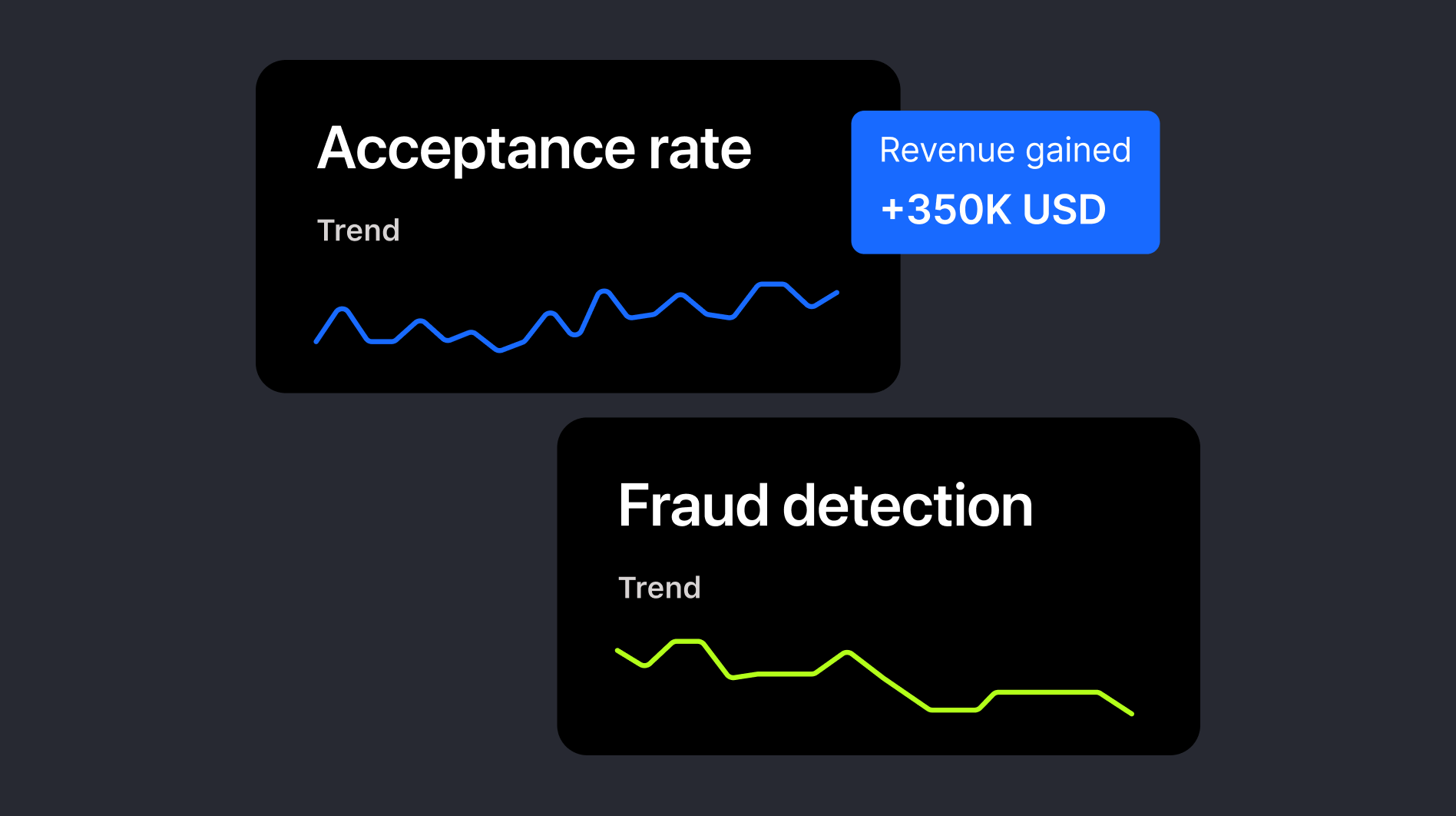

Our payment processing solution helps you track, analyze, and optimize every payment you take – allowing you to monitor insights, then draw upon them to adapt your business’s offerings to the ever-evolving expectations of your audience.

We’ll help you harness techniques like straight through processing (STP) to automate error-strewn manual prepayment processing – and enjoy faster, more seamless payments. And, through automated payment reconciliation, take the dread and drudgery out of one of accountancy’s most tiresome tasks.

Ready to boost your business’s prepayment and reconciliation processes – and discover an end-to-end payments solution that actually works for you? Get in touch with the team here at Checkout.com today for a no-obligation chat. Your accountant will thank you!

.jpeg)

%20v1.jpg)

.png)

.png)