Ecommerce is growing steadily as a proportion of global retail sales, from 18.8% in 2021 to a projected 22.6% in 2027.

With such a vast online opportunity, businesses are thinking digital-first but also cross-border by default. However, cross-border ecommerce expansion is not without its challenges, especially when it comes to payments.

Here, we look at the main payment challenges you might encounter when supporting your company’s expansion into new markets.

What is cross-border ecommerce?

Cross-border ecommerce, also known as International ecommerce, is selling across borders online as opposed to within one country. While it focuses only on digital sales, it’s open to both physical stores and online-only businesses looking to sell internationally from an ecommerce website or online marketplace.

How does cross-border ecommerce work?

Cross-border ecommerce involves selling products in different countries. It starts by establishing an online presence, often through a website or online marketplace, and then addressing logistics like international shipping, customs, and taxes. Then, once you’ve sorted out your payment processing and currency conversion, you’ll need to maintain trust through secure online transactions and clear communication about shipping times and fees.

As with any cross-border strategy, your business must comply with the regulations and legal requirements of both your home country and the target market. This can help your business successfully navigate any potential roadblocks to selling across borders.

Cross border vs local acquiring

In the complex world of global payments, the differences between cross-border and local acquiring are something businesses operating on a worldwide scale will need to consider.

Cross-border acquiring

In a cross-border transaction, the merchant uses an acquirer based in one country to process transactions from customers in another country. This often involves higher fees and lower acceptance rates due to a lack of familiarity between the issuing and acquiring banks. There are also potential currency exchange issues, which can lead to a less-than-optimal customer experience and increased operational costs for the merchant.

But by no means is cross-border acquiring all bad. It can still unlock huge opportunities for merchants around the world and is much simpler to execute than a payments strategy built around local acquiring only - where you will need a local entity in each country.

We’ll go into more detail on the advantages and challenges later in the article, but first, let’s look at local acquiring.

Local acquiring

Local acquiring refers to the process of using an acquirer based in the same country as the customer who is making the purchase. This approach significantly mitigates many of the challenges associated with cross-border transactions. Local acquiring allows transactions to be processed within the same regulatory and financial infrastructure as the customer’s issuing bank, leading to higher acceptance rates, lower fees, and a better payment experience.

The main challenge with local acquiring is that it is not straightforward to set up in a truly global way.

Working with a payment service provider with local acquiring licenses around the world - like Checkout.com - will certainly help, but there are still many things you will need to consider as a merchant.

We have a dedicated article that covers the topic of local acquiring in more detail. Let’s get back to cross-border payments and further detail the advantages and challenges.

Advantages of cross-border ecommerce

Consider all the fantastic benefits cross-border ecommerce will bring to your business:

Access to new markets

There’s a world of opportunity and an enormous number of new customers beyond the borders of the country you’re based in. Cross-border ecommerce allows you to take full advantage of this global potential by expanding into untapped markets.

Increased sales opportunities

Every new market you expand into vastly increases the number of potential customers you’re exposed to and the number of sales you can make, resulting in a massive boost to your revenue and profit.

Improve brand awareness

Trading in new markets doesn’t just generate a material benefit; it also leads to brand awareness on a global scale. This recognition will help give your business staying power and make it easier to expand into other new markets.

Competitive strength:

As the barriers to entry for cross-border ecommerce have lowered, more businesses are targeting global expansion. This means that if you don’t do it first, your rival will. Get ahead of the competition by being the first to launch in a new market and reap the rewards. This first-mover advantage is ongoing, especially if you have a novel product or service, as your brand will forever be associated with the concept in a way that rivals can’t hope to compete with.

Challenges for cross-border ecommerce

Embarking on the journey of cross-border ecommerce presents a range of challenges that businesses must be prepared to navigate. Understanding and addressing these obstacles is crucial for companies aiming to expand their online presence globally. This comprehensive overview highlights the primary hurdles encountered in international ecommerce, emphasizing the importance of being vigilant and proactive.

1. Understanding the local market

Selling online means that you’re open for business 24 hours a day to customers all around the world. So, it’s easy to see why ecommerce seems a natural route to market for ambitious companies looking to grow.

However one of the barriers to cross-border growth is payment. Business goals and online sales may be global, but payment remains a local affair. It’s no exaggeration to say that there are more local payment methods worldwide than trading days in a year.

Local or alternative payment methods include everything from cards and bank transfers to e-wallets and mobile wallets, cash-based payments and buy-now-pay-later options. And with local payment methods being the default way to pay in many markets, you need to understand which ones best fit your business and customers.

Understanding the local payment landscape isn’t straightforward. Nuances in the way people pay aren’t always clear at first glance. That’s why the world’s most progressive markets partner with payment experts who have deep local knowledge in the markets they operate in.

Read more: What is local acquiring and how does it unlock ecommerce growth?

2. Getting paid efficiently

International expansion can increase payment complexity. Think about it this way: if you add 12 different payment partners to your tech stack, that’s 12 separate contracts, integrations and project plans. And that’s even before you get paid.

You may have 12 different settlement dates. You have to agree on processing and settlement pairs for each local currency you accept 12 times over. It’s no wonder that getting paid can quickly become unwieldy and inefficient.

It's a big problem. 72% of businesses aren’t receiving their preferred settlement currency. Our research shows that 71% don’t receive their preferred settlement frequency. That’s a significant blow to treasury and liquidity management, especially in these straightened times.

3. Managing fraud risk

Fraud is a growing risk no matter what market your business is operating in. But there are markets where the risk of fraud — both friendly and deliberate — intensifies significantly and becomes a real challenge to overcome.

While you can’t expect to eliminate the risk, you need to think carefully about the safeguards you have in place to mitigate its impact. And balance these against the impact false declines may have on customer experience.

It’s a tricky balancing act. Your decisions will need to consider many factors, including each market’s unique risk profile, your sales volume and ambitions in the market. And you need granular data in your payment flows to make informed decisions.

4. Be aware of regulations

Business, fraud and regulation are always evolving at a rapid pace. Be it Strong Customer Authentication in Europe, the fragmented approach to regulation in the US, or China’s new ecommerce laws.

Staying on top of these changes in just one market is challenging. And that complexity skyrockets the more markets you do business in. As a result, keeping up, let alone staying ahead of regulatory changes, is a full-time job.

But it’s non-negotiable, and falling foul of the rules can severely impact your business in the shape of fines and penalties — or worse. Therefore, payment pros must find a way to stay compliant in an efficient and scalable way so it doesn’t consume all your budget and resources.

5. Using data effectively:

The data your business generates from cross-border trade will be invaluable when it comes to optimizing your global operations. Make sure to partner with a payments provider that gives you access to granular, actionable data so that you can see exactly how money is flowing through your business, identify and fix any issues, and uncover new opportunities. Effective use of data leads to informed and effective decision-making and allows you to measure the success of your initiatives.

Planning for global expansion? Find out how Checkout.com can support you every step of the way.

6. Managing higher costs:

You’ll need to take into account varying taxes and fees. You’ll have to comply with a new tax regime in whichever country you trade in. That means registering with tax authorities, obtaining licenses, filing tax returns, and calculating and paying any local taxes your business is eligible for.

You will also need to budget for the additional fees charged by credit card schemes. These could include a cross-border fee (usually a set percentage of each payment) to cover the added cost of complex and risky international transactions and a currency conversion fee to cover the cost of exchange.

Shipping

If you’re sending products to other countries, you’ll need to factor in the cost of a logistics partner, longer shipping times, and import and export duties. The complexity of international shipping does increase the chance that your goods will face issues in transit. Still, with adequate planning and preparation, you'll be able to lessen the impact of those issues when they occur.

Return problems

As mentioned above, returning goods can be as challenging as the outward journey, which can be frustrating for your international customers. Make sure to communicate clear returns and refund policy to make it as easy as possible for your customers to send goods back to you, which will reduce the chance of chargebacks or damaged loyalty.

Optimize cross-border ecommerce payments with Checkout.com

Planning for global expansion in ecommerce? Find out how Checkout.com can support you every step of the way.

With our ecommerce solution, you can accelerate market expansion with access to over 150 processing currencies and 25 settlement currencies and leverage developer-friendly tools for seamless integration through hosted payments and ecommerce platforms.

In 2023, we secured our acquiring license in the United Arab Emirates and now have direct acquiring capabilities in 38 countries globally. This means we can support you with a quick and simple integration that enables you to benefit from many of the advantages of local acquiring in any market where you have a legal entity.

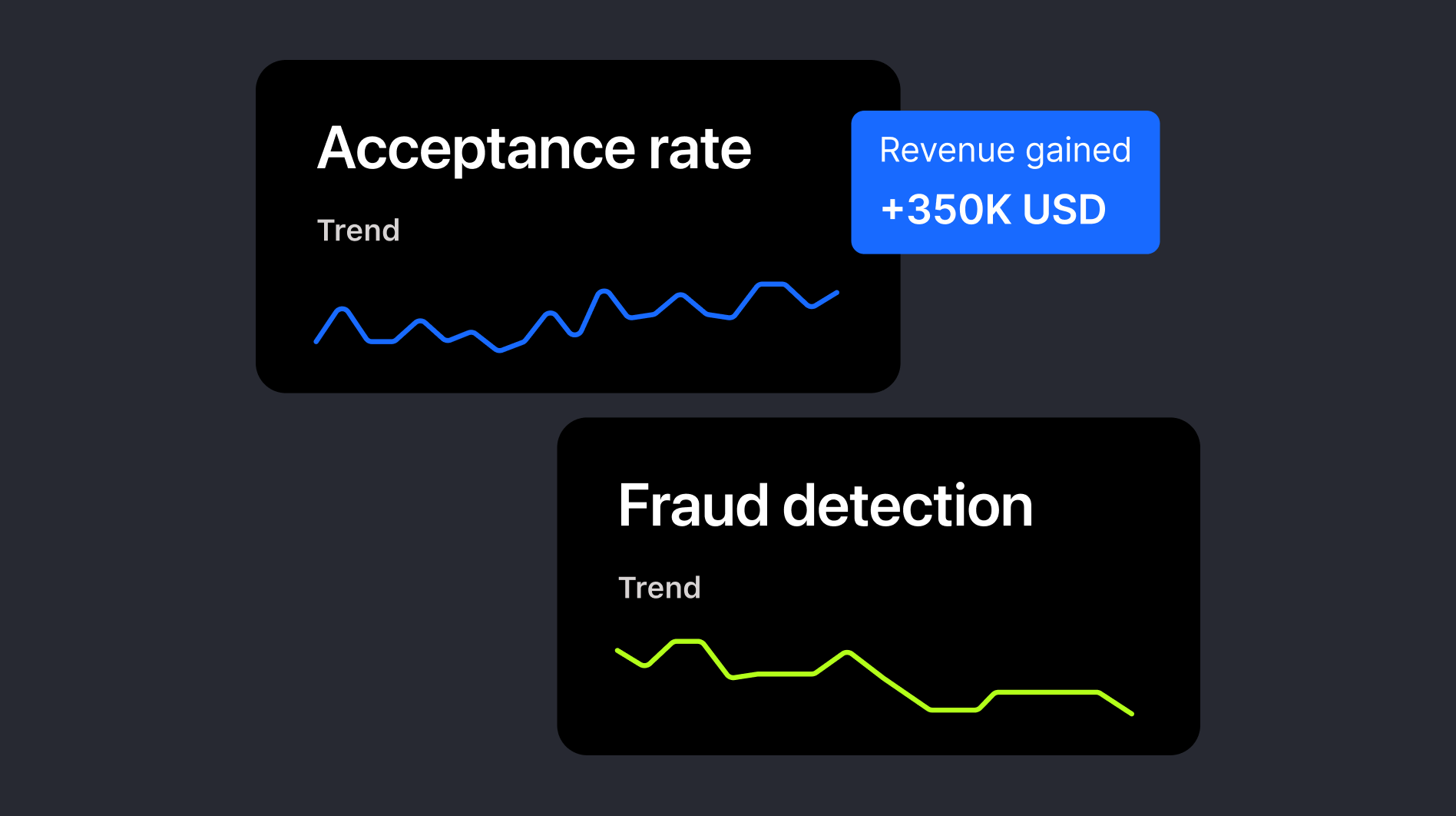

Merchants can also benefit from our Intelligent Acceptance product, which uses AI and our global data network to optimize their cross-border payments. This results in an increased conversion rate, fewer false declines, lower international transaction fees, and more revenue.

Talk to our sales team to learn more about how our ecommerce solution can help scale your business today. You can also look at our guide about how to turn expansion into growth to check all the necessary steps on your path toward expansion.

.jpeg)

%20v1.jpg)

.png)

.png)