Automatically optimize every payment with Intelligent Acceptance – an AI engine designed to increase conversions and revenue.

.webp)

Capture every possible payment and boost acceptance rates with real-time optimizations.

Get hundreds of optimizations working for you with no manual work or additional integrations.

Stay ahead with models continuously adjusting to trends, regulations, and issuer preferences.

Capitalize on fraud insights to lift acceptance without being exposed to risk.

Intelligent Acceptance is built to maximize payment performance and bring tangible revenue gains.

*Between 2022 & 2024 for Checkout.com merchants

acceptance rate uplift on average across global brands

in additional revenue generated for our merchants to date

optimizations performed daily to power leaps in transaction success

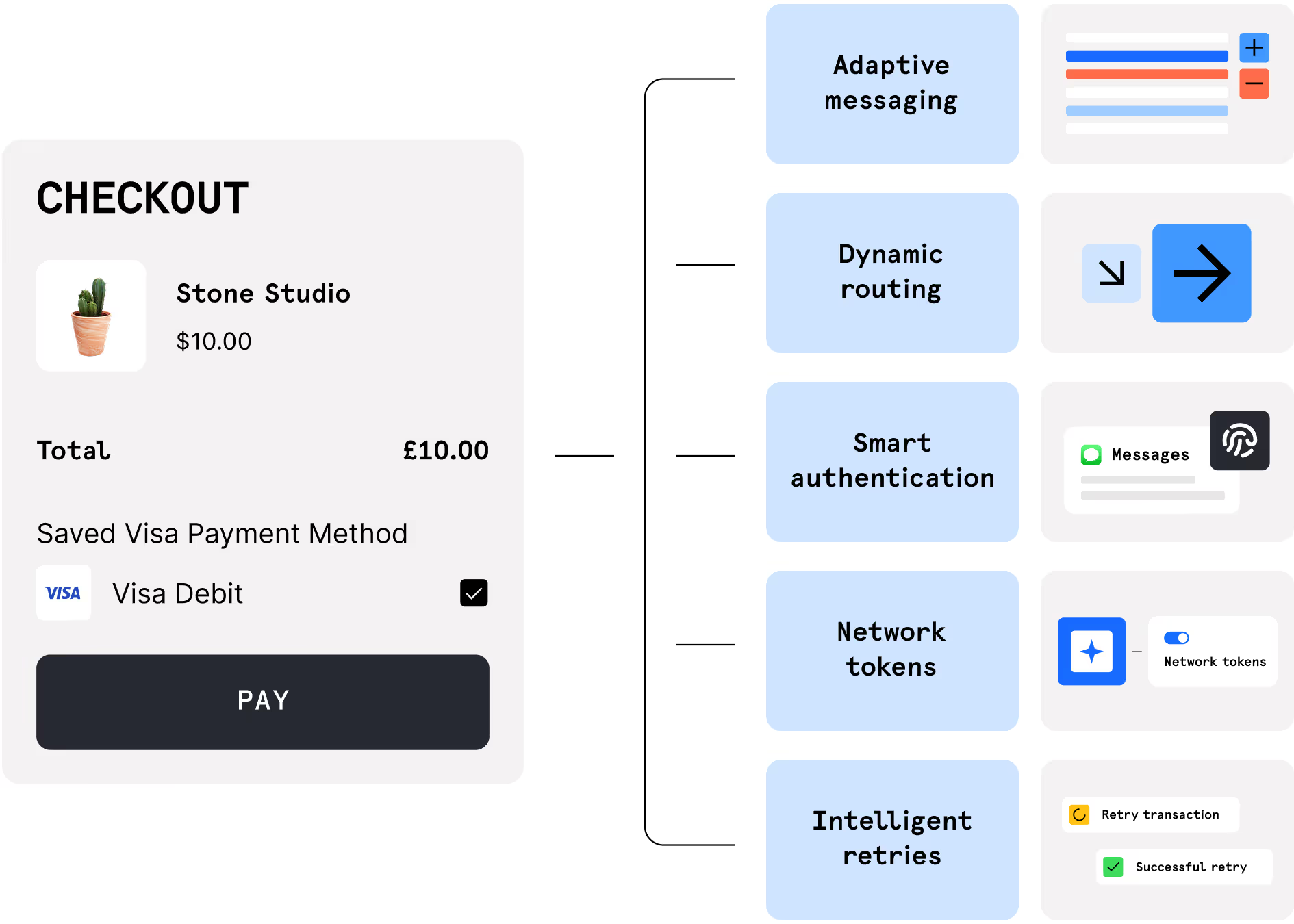

Relevant optimizations are applied automatically to maximize the payment success rate.

Adjust data to fit issuer and network preferences.

Find the best path across debit, local, or global networks.

Apply the right verification and exemption type.

Enhance security, increase acceptance, eliminate churn.

Automatically recover failed transactions in real time.

Optimize payment flows based on issuer preferences, regulatory requirements, and your goals

Striking perfect balance between acceptance, security, cost and user experience. Intelligent Acceptance applies Network Tokens when they are accepted by issuers and bring the highest chance of approval.

Make the most of 3DS without killing conversions. Relevant exemptions and authentication flows ensure seamless experience for legitimate users, leaving challenges for gray areas.

Dynamically route transactions across local and global brands. Whether your focus is cost or approval rate, Intelligent Acceptance would offer the most beneficial path based on your goals.

Enjoy full flexibility to optimize payments your way based on your payments stack, market needs, and consumer preferences. Intelligent Acceptance can be applied to certain products or act as a performance layer across your payment flow.

By focusing on data quality and traffic health, you can capture hidden revenue, ensure compliance, and deliver a seamless checkout experience.

Effortlessly spot issues like missing fields or conflicting flags before they undermine revenue.

See transaction-level impact, unrealized acceptance basis points, and recommended fixes.

Track improvements over time and watch your acceptance climb while fraud-related declines drop.

Find out how we can help your business go further.

.png)

Greta Atminaitė

Strategic Partnerships, Payments at Vinted